Turbulent times in the property market

Share

Turbulent times has resulted in an equally turbulent housing market. The overall upward trend hides huge losses felt by an unlucky few.

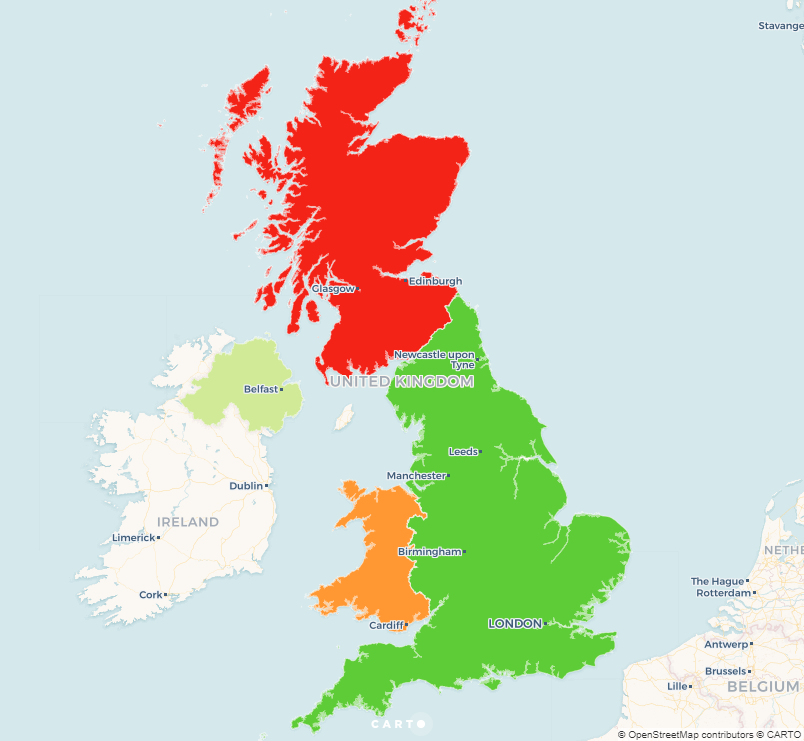

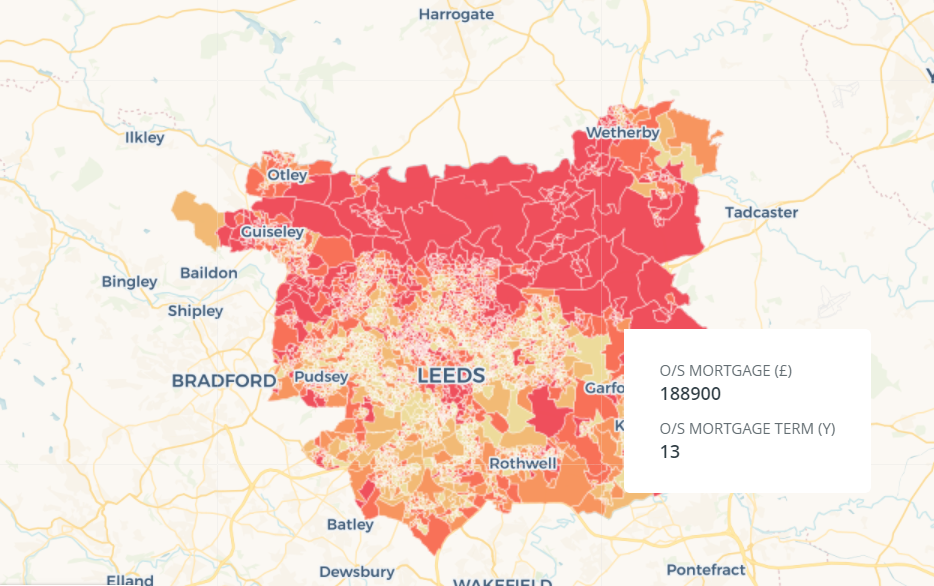

After a relatively stagnant market in recent years, house prices have seen unprecedented growth. As shown in the graph below, house prices rose nearly 12% from January to September 2020. Many factors, such as the governments ‘stamp duty holiday’ and a supply/demand imbalance has created a perfect storm inflating property prices.

This level of inflation, however, is not sustainable and there are plenty of causes for concern. The end of the stamp duty holiday on the 1st of April 2021 is expected to negatively affect the market. As well as this, faith in inner-city flat markets has plummeted following the fallout of the Grenfell tragedy. According to the Daily Mail, 1 in 7 flat sales are under threat as lenders and insurers grow increasingly concerned over the safety of exterior cladding.

Why the up swing?

In response to the crash in property sales during the first lockdown, the government suspended stamp duty for the first £500,000 of a property’s value in an attempt to boost the market and protect jobs. This was a substantial raise from £125,000 (or £300,000 for first-time buyers). According to a government study, a third of home buyers stated they would spend the money saved on home renovations, further boosting the economy. However, the scheme has come under criticism with some MP’s claiming it is merely a tax break for wealthy property owners and others pointing out its failure to increase house sales (see below). The argument is that without the tax break the fall in house sales would have been even worse.

Graph created using DoordaStats

The increase in prices is also likely due to people looking to move from cities to the countryside. In June and July, Rightmove reported a 126% increase in people considering homes in villages when compared with the same period in 2019.

The stamp duty holiday combined with people looking to move out of cities has resulted in huge demand. Buyers have reported a small supply of new houses to the market, powering the dramatic increase in property prices as buyers enter a bidding war to secure their dream home.

Winners and Losers

The benefits felt by this activity have not been universal. Owners of large detached homes in the country have been the biggest winners following huge demand from people looking for more space to work from home. Inner-city flats have felt the opposite effect as outdoor space has become a highly valuable asset. Some flat owners have been unable to sell entirely due to lenders confidence being shaken by the safety concerns of Grenfell-like cladding. The Times recently confirmed that over 200,000 flats across the country are wrapped in the same, or similar, cladding as Grenfell. New government proposals could force flat owners to pay £40,000 on average to replace unsafe cladding.

Graph created using DoordaStats

Our data displayed above shows sales in detached homes fell by 10% since the start of 2020, whereas flat sales dropped by over 40%.

Turbulent times

Multiple factors affecting housing prices simultaneously has created an extremely turbulent market. The gap between the winners and the losers is as big as ever. Everyone wants to know when this growth will subside. Many believe the end of the stamp duty holiday will reduce demand and with COVID-19 vaccines being rolled out across the country, lockdowns could become far less frequent, convincing homeowners to sell. This could flip the supply/demand balance on its head and put a halt to high growth rates. Another factor to consider is the boost to the economy coming out of lockdown will provide. This will likely have a positive impact on house prices.

In these turbulent times, it seems the only certainty is uncertainty. Overall the only advice we can give is, whether your buying or selling, make sure the timings right.

Sources

Stamp duty holiday: Gov.uk1, Gov.uk2, BBC

Cladding: Daily Mail, The Times

Want even more data on your customers?

We hold data on crime, health, income and so much more, all to extremely granular levels.

Find out more