New Release: GDPR-Compliant Council Tax Band Data — Now Available

Organisations can now access a single, comprehensive dataset of UK Council Tax bands and precepts — clean, structured, and ready to use. If you’ve ever tried to gather Council Tax data across the UK, you’ll know it’s one of the most fragmented datasets in the public domain.

Non-Compliant Council Tax Band Data is a Legal Risk!

Organisations are always on the lookout for high-quality datasets to improve customer insight, build smarter models, and gain a competitive edge. But not all data that looks public is legally safe to use.

Council Tax Bands: A Hidden Asset for Business Intelligence

For many, council tax bands are just part of a household bill. But for businesses and analysts, they represent something much more valuable…

Fixing the Fragmented Landscape of UK Council Tax Band Data

In the world of open data, few public datasets expose systemic dysfunction quite like UK Council tax bands.

Hidden property data that Insurers and Marketers can’t afford to ignore

What if you could understand not just where a property is, but when it was built – and what that says about risk, opportunity, and consumer behaviour?

How Doorda’s Procurement Data Can Help Lenders, Insurers and Underwriters

In today’s volatile credit environment, invoice insurers, underwriters, and lenders need every edge to stay ahead of risk. Analyse all government, local authority and NHS procurement above £12,000.

Locking Down MoT risks: The Power of Location & Operator Data

Our new licensed MoT garages dataset isn’t just a list of garages—it’s an intelligence opportunity.

Why Government Spend Data Is a Game-Changer for Your Business Strategy

In an era where data rules decision-making, tapping into every available insight is essential. Yet one of the richest, most underexploited sources remains government spending data.

A Brief History of Government Spend Data

Since the early 2010s, the UK has led the way in using open data to hold public bodies to account with all local authorities and government bodies now required to publish invoice level data.

£1.8m in claims a day! The Role of Hard Water and Its Impact on Properties

Water escape, or “escape of water,” remains a persistent challenge in the UK, causing significant damage to properties and leading to costly claims for insurers and underwriters.

Explore all our data products via DoordaOnline

Our new user-friendly, web-based interface is designed to simplify data exploration and querying, making it much easier to access 100s of datasets efficiently and intuitively.

Weaknesses in public data threatens predicted AI gains

The rapid growth of artificial intelligence faces significant threats due to a shortage of high-quality data, a fundamental issue restricting AI’s potential across numerous sectors.

New Release, Water Hardness Linked to Postcodes

New release, unique dataset linking UK water hardness levels to 1.6M postcodes providing valuable insights for insurance companies and those interested in property.

Unlock Deeper Insights into Commercial Locations

We are thrilled to announce the launch of CommercialX, offering comprehensive insights into over 6 million commercial properties across the UK.

National Data Library, the way forward

Supporting the UK Government’s National Data Library Initiative

Navigating the Economic Crime and Corporate Transparency Act

Upcoming Changes in the Economic Crime and Corporate Transparency Act: What Data Consumers Need to Know

Unveiling DirectorX: Precision Insights for Smarter Marketing & Compliance

In today’s business landscape, data is a powerful asset that enables better decision-making, drives strategic marketing, and supports regulatory compliance. That’s why we’re thrilled to introduce our new Director Data Product.

Guiding Companies Toward Climate Action and Compliance

The Science Based Targets initiative (SBTi) is an organization that helps companies and financial institutions set goals to reduce their greenhouse gas emissions

Grey Data isn’t Good for Business

Using scraped or grey data for building data models can present several risks and ethical concerns, which is why it’s generally advised to avoid relying on such data.

Address Insights Reimagined

In today’s dynamic business environment, particularly within the retail, real estate, and service sectors, leveraging precise location data has become indispensable.

Point Sigma Improve AI-driven Analytics

Identifying and swiftly responding to data-driven insights across a range of needs from marketing and credit risk through to customer service and collections is now a common, business critical requirement.

Stop Scraping Open Data!

Looking back into the deep dark days of the early web Before the advent of open Apis Schema.org and RDF, and definitely, well before Artificial intelligence, visual web scraping was one of the very few ways to get structured data out of the web.

Why Data Management is far from ‘NIRVANA’.

Using external data, in particular, to enrich context, improve accuracy or broaden scope matters significantly if data practitioners are to deepen insights, improve predictions, or personalise offerings.

What does chronological age mean?

Chronological age is a concept that measures the number of years a person has been alive since birth, chronological age forms the basis of our understanding of time and aging.

Comparable Areas, OA or LSOA?

Lower Super Output Areas (LSOA) fit within Local Authority boundaries and Output Areas (OA) fit within an LSOA. These were originally developed as part of the census to allow for comparison across different parts of the country.

Experienced data buyers discover Doorda via Nomad Data

Doorda, a UK data provider specializing in property, business, and geo-demographic data, has partnered with Nomad Data to discover sophisticated data buyers

Insuretechs look to Doorda to construct better client and risk profiles

Doorda provides the insurance sector, from brokers and underwriting platforms to established tier-one insurers, with reliable UK data to improve assessments and recommendations.

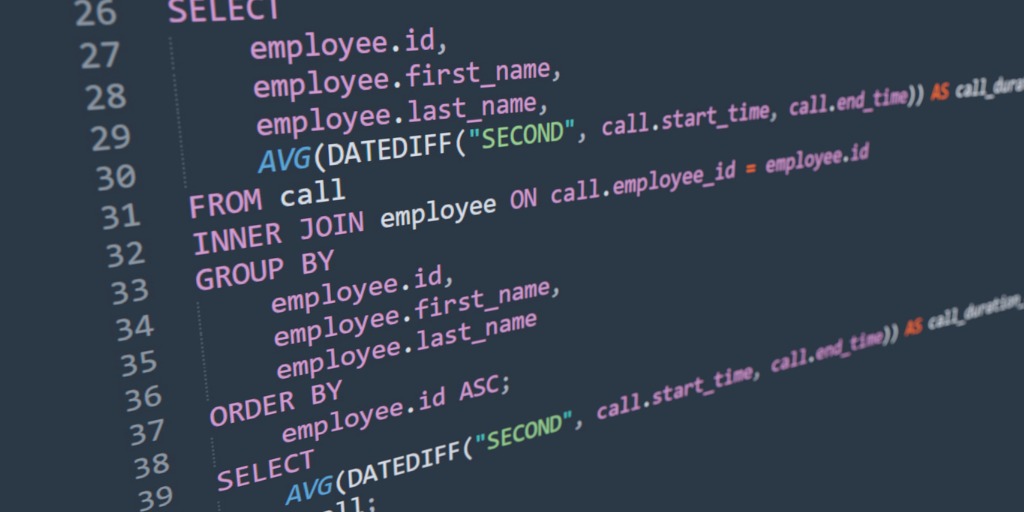

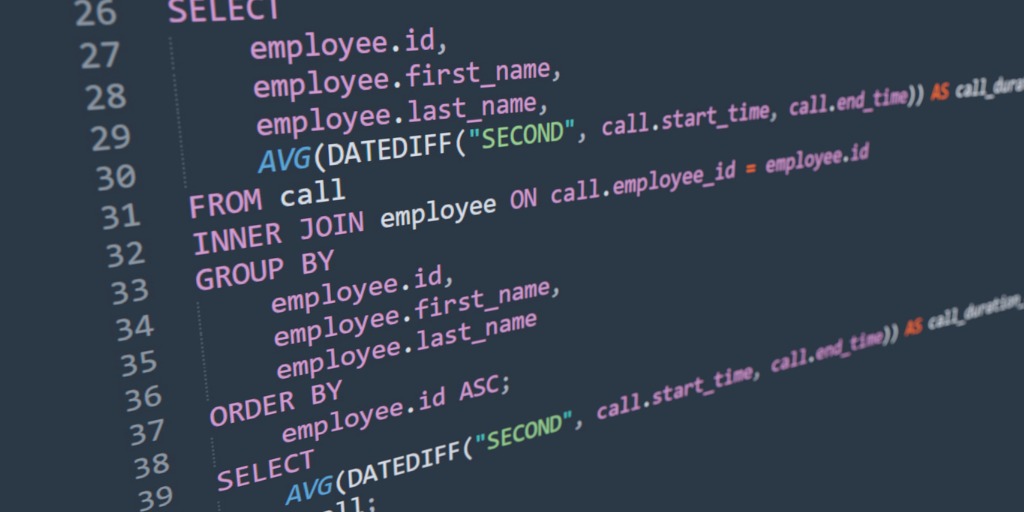

Using INNER JOIN versus CROSS JOIN in SQL

Using the right JOIN statement in your SQL code is critical for accurate results. While it might be easy to identify a bad data set when only a few results are returned, it’s not so easy when you have thousands of results.

Should You Use NULL values in Your SQL Database?

If you search for NULL standards in Google, the first page shows you answers from both sides of the debate. Using NULL values in your database is a permanent choice. Once you choose to allow them, you need to allow NULLs in all SQL database tables.

Government and Open Data for AI Start Ups

AI and machine learning start-ups are some of the most exciting and interesting businesses out there today. They are curing diseases, trading trillions of pounds of stock, and making sure your home assistant can understand what you want when you say “OK Google”.

4 Useful Tips for Working with R and RStudio

Working with R and RStudio can be very rewarding as R is one of the most powerful data processing and data visualization programming languages available.

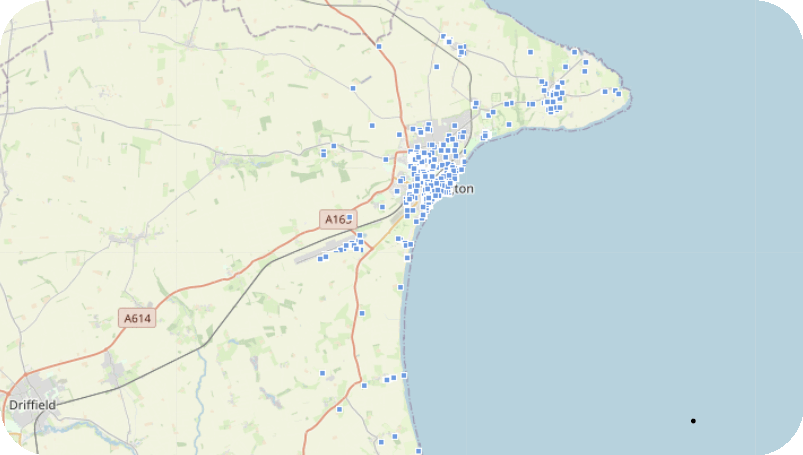

Smoking rates across the UK

Whilst smoking rates are trending downwards nationally there are still pockets where smoking greatly exceeds expected averages. In 2018, 14.7% of people aged 18 years and above smoked cigarettes.

Your biological age can go into reverse

Biological age refers to how old your body seems, based on various physical and functional markers, rather than just counting the years you’ve been alive.

Life expectancy, who wants to live forever?

Life expectancy is a statistical measure that estimates the average number of years a person is expected to live based on various factors such as their birth year, gender, and the overall health and living conditions of a population.

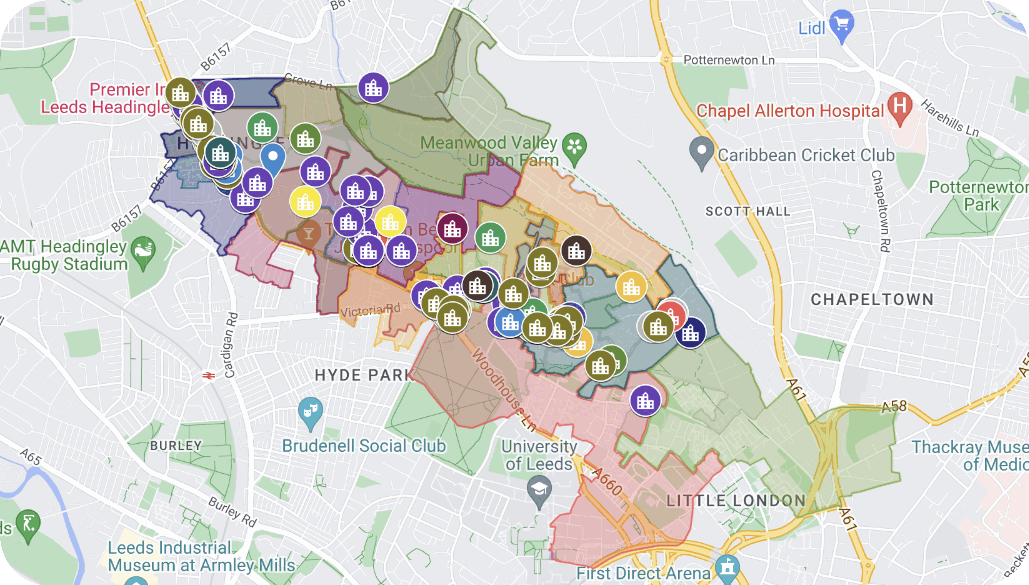

Identify the best locations for new stores using data

Data is a cornerstone of effective location analysis, providing critical insights for businesses aiming to make informed decisions about where to establish their presence.

4 easy ways to Optimize SQL Queries and Enhance Security

The fastest way of improving response times is to Optimize your SQL Queries. Your backend SQL server be it MYSQL or Microsoft is the powerhouse of application performance.

What Our Customers are Saying

“Doorda was differentiated given their unique proposition”

Nigel Wilson

Partner, Deals Insight & Analytics, PWC

“We had to acquire masses of data about the local population as soon as we could”

Vivienne Parsons

Specialist Business Analyst, South Central Ambulance Service

“The new partnership gives our clients more available depth within our existing data products”

Kelly Preston

Managing Director of 118/Market Location

“Doorda has become a trusted data partner and we think there’s a lot more we can do together”

Scott Logie

Customer Engagement Director, Sagacity

“Doorda brought us data we hadn’t seen before”

Mao Ruijia

Lead Growth Analyst, Capital on Tap

“The acceleration in time to value for CARTO customers is a clear win-win.”

Luis Sanz

CEO, CARTO

“Doorda excels in providing the detailed, raw data that is so key”