Government Crackdown on Late Payments

3 minutes

Prompt Payment Code

In 2008, the government introduced the Prompt Payment Code (PPC) in a response to businesses calling for a stop to late payment culture. Late payments can seriously disrupt cash flow management, especially in SMEs and can even cause a recession if the problem gets out of hand.

Signatories of the PPC agree to:

Pay suppliers on time:

- Within the terms agreed at the outset of the contract.

- Without attempting to change payment terms retrospectively.

- Without changing practise on length of payment for smaller companies on unreasonable grounds.

Give clear guidance to suppliers:

- Providing suppliers with clear and easily accessible guidance on payment procedures.

- Ensuring there is a system for dealing with complaints and disputes which is communicated to suppliers.

- Advising them promptly if there is any reason why an invoice will not be paid to the agreed terms.

Encourage good practice:

- By requesting that lead suppliers encourage adoption of the code throughout their own supply chains.

New Legislation

As of 1st July 2021, signatories of the PPC must pay 95% of invoices to small businesses within 30 days as part of a raft of measures taken to tackle the ongoing issue of late payments. The target for larger businesses will remain 95% of invoices within 60 days.

“Far from being a victimless act, the failure of large businesses to pay smaller suppliers promptly jeopardises the survival of many companies, putting at risk livelihoods and jobs”

Iain Wright, Director for Business and Industrial Strategy at ICAEW

Payment Practice Data

Regulations made under section 3 of the Small Business, Enterprise and Employment Act 2015, introduce a duty on the UK’s largest companies to broadly report on a half-yearly basis on their payment practices, policies and performance for financial years beginning on or after 6 April 2017.

A large business is a company or limited liability partnership that has at least two of the following:

- £36 million in turnover

- £18 million on its balance sheet

- More than 250 employees

This data is now included in DoordaBiz and includes:

- Average time taken to pay invoices

- Percentage of invoices paid within 30 days, 31 to 60 days and more than 60 days

- Percentage of invoices not paid within agreed terms

- Shortest and longest standard payment period

- If payment terms changed in the reporting period

- Whether the company has signed up to the PPC

- And much more…

Example

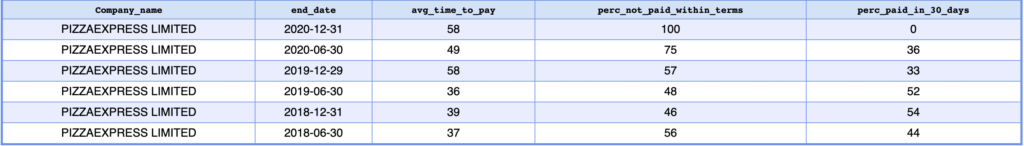

It can be accessed from DoordaHost using a simple SQL query. For example, let’s look at how fast Pizza Express has been paying its invoices…

select company_name, end_date, avg_time_to_pay, perc_not_paid_within_terms, perc_paid_in_30_days

from doordabiz_snapshot.doordabiz_snapshot.addon_company_payment_practice

where company_number = '01404552'

Here we can see the average time to pay has been on an upward trend since 2018. The same trend is seen for the percentage of invoices paid within the terms of the contract, with 100% not paid within the terms for the period ending 31st December 2020. As well as having a detrimental effect on the suppliers, this could be a sign the company is struggling with their own cash flow.

Late payments have become part and parcel in post-Covid Britain, leaving many SMEs struggling to make ends meet. It’s this kind of behaviour the new PPC legislation is aiming to put a stop to in order to help the economy come back stronger.

Sources: ICAEW, Small Business Commissioner